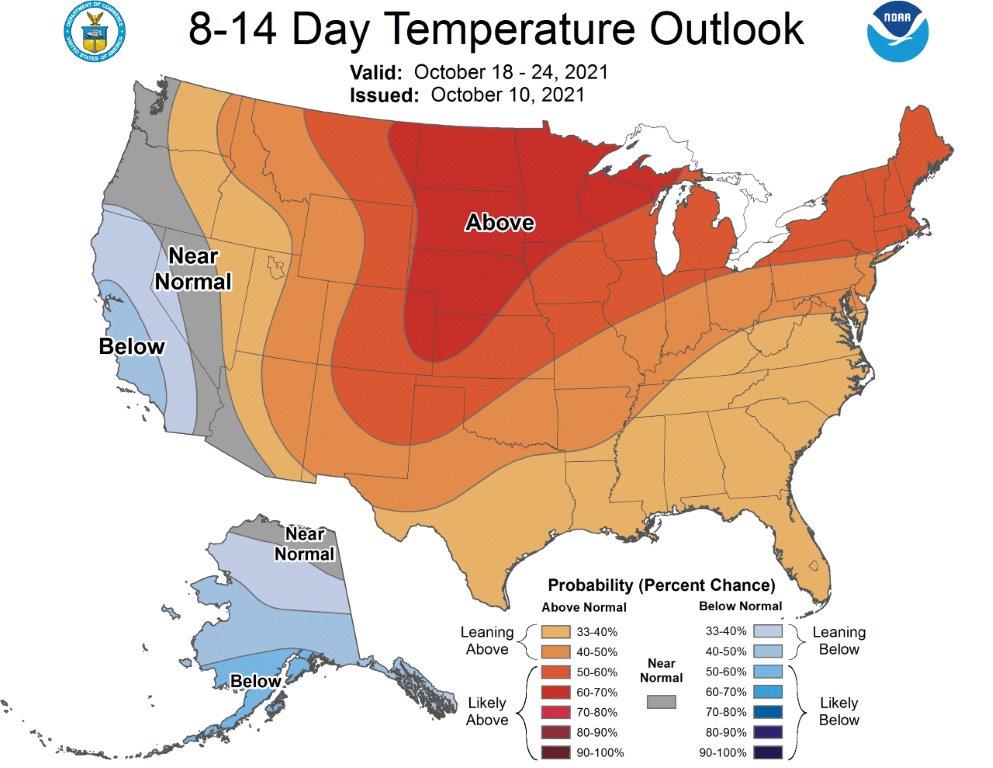

Therefore, based on these four charts, it was not surprising with NOAA forecasting milder than normal weather over the next 8 to 14 days, Natural Gas pulled back from a seven year high. But based on today’s fundamentals should we expect Natural Gas will rally to a new high in December as it did in 2000, 2002, 2005, and 2013?

I believe it will, but to understand why, you must remember Natural Gas’ present rally is based on the long-term and short-term factors discussed in my Oct 4th Energy Update. It rallied this year due to the Biden’s administration’s energy policies and fear of inflation in the U.S., along with a 10-year low in Europe’s Natural Gas supplies caused by their green energy policies.

And as I wrote last week, if we experience a colder than normal winter analyst are warning Natural Gas prices could be above $10 per MMBtu. I was not predicting it would happen, but it is certainly a possibility.

But why similar to 2000, 2002, 2005 and 2013 should we expect after completing its fall low, Natural Gas will likely make a new high in December?

It is based on the fact that although the fear of a cold winter is factored into the market, it is too early for the market to know for sure it will happen; therefore, a pullback now is not surprising, but after reaching its fall low due mild weather as we move closer to the winter hedgers will reenter the market and likely push the market to a new high in December.

If we don’t experience a cold winter than similar to 2000 and 2005, Natural Gas will decline from its December High, but if we experience a colder than normal winter, then similar to 2002 and 2013, Natural Gas will far surpass it December high next year.

But either way, I believe Natural Gas will be higher in December than where it is presently, and it would be wise to take advantage of the current mild weather pullback to secure hedges.

As I wrote in last week’s report, No one knows for sure where Natural Gas and Electricity prices will be over the next 6-months, but I firmly believe as stated in my most recent reports, three years from now you may look back and realize there was only one cost of doing business you could have stopped increasing, your cost of energy for Natural Gas and Electricity.

Not every client’s risk tolerance and hedging strategy is the same, but the above report will help you put into perspective the risk/reward opportunities. I invite you to call one of our energy analysts to help you plan a hedging strategy appropriate for your situation.